Distribution • June 13

Distribution means many things in finance and markets, but in charting it can be referred to as a consolidation period that breaks down. As the market agrees on a price, it trades in a range. If the chart breaks out upward, it is called accumulation. This can be described as distribution. Everyone who got long in the region between the red brackets got smoked. On the 15 minute SPY chart you see 8 days of low volume consolidation. All of the volume came on the closing prints – on May 31, the market-on-close order was over $4b to the buy side. You could call it end of month window dressing, options expiration, whatever. I see it as a lot of people getting bagged. The greatest lesson in trading is to not baghold a bad trade – take the loss. “We’re in the market to make money, not to be right.”

Well that was a terrible time to adjust the regression channel. Today the market got smoked as the 10 yr moved to 3.35, while both the golden pocket fibs and regression channel acted as resistance. Your next levels lower are large volume days and support areas. We’ll see what the Fed does Wednesday. Who knows if Powell has the stones for a 75bp hike…a guy can dream.

Oil

Although the equities look rough, the commodity remains strong.

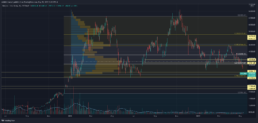

Bitcoin

Crypto is absolutely falling apart. The large US corporations, El Salvador, and most retail wallets are underwater on their BTC investments. The rest of the crypto complex also looks like death. I’ll start adding to ETH after it breaks 1000.